(I’ve updated the post with a correction on the VIRL library fees thanks to info from ACRD Director from Long Beach Tony Bennett)

People really love to complain about their taxes. Â If they didn’t there wouldn’t be a meme about it (left). Â And since the AVNews ran a story in December with the headline that the City was raising taxes by 7%, the questions and complaints have been pouring in.

Now, first things first, the City has not decided to raise taxes 7%.  In fact, it hasn’t decided anything.  The story was simply based off the first draft of the financial plan that City Staff have to create every year so that we know where we are starting from, what costs have risen over the year, what capital projects we committed to in the coming years, etc.   There are weeks of deliberations to go before a final plan is adopted.  I hope as many people as possible can either come to or watch online the public budget meetings that start next week.  You can see the full schedule and all info about the budget as it is created on the CPA website

There are weeks of deliberations to go before a final plan is adopted.  I hope as many people as possible can either come to or watch online the public budget meetings that start next week.  You can see the full schedule and all info about the budget as it is created on the CPA website

The reason for this post though is because I wanted to share with you a specific email that I got from a resident. Â His question I think encapsulates a lot of the discussion and tension in Port Alberni and in surrounding districts about the tax situation. Â It also shows some of the misunderstanding and incomplete information people may have. Â He’s given me permission to reproduce it here.

Here is what he said:

Hello Mr Alemany hope all is well and happy new year. Question, was chatting with friend who owns house off Kitsuksis, house worth 750k and he pays same amount of property tax as me whose house worth 220k. I get that he’s considered Beaver Creek but we pay water/garbage seperate from prop tax so why the Huge discrepancy? We all use Arena, Echo, their kids go to same schools, hospitals and drive on same roads. Only diff i can tell is some in city have sidewalks/street lights and in city we have fire dept. they have fire too but volunteer i understand. And like i said earlier garbage and water we have extra bills so that shouldnt factor into it. Am i missing something? The system here just dosnt seem fair especially since many of people on outskirts of town have way more money and nicer house then in town. Not all but on average. What do you think?

The text below is my response to him with some additions and I have added images and graphics so that it is better illustrated than just the email I sent him alone:

It’s a great question, and a very important one. It all comes down to knowing what services are actually subsidized or completely paid for by the provincial versus the city government.

It is easiest to say first what is covered by the province and we all pay the same: Hospitals and Schools [correction—>and Libraries] are the big ones, Â on your tax form these rates are the same no matter if you are in the City or in Beaver Creek.

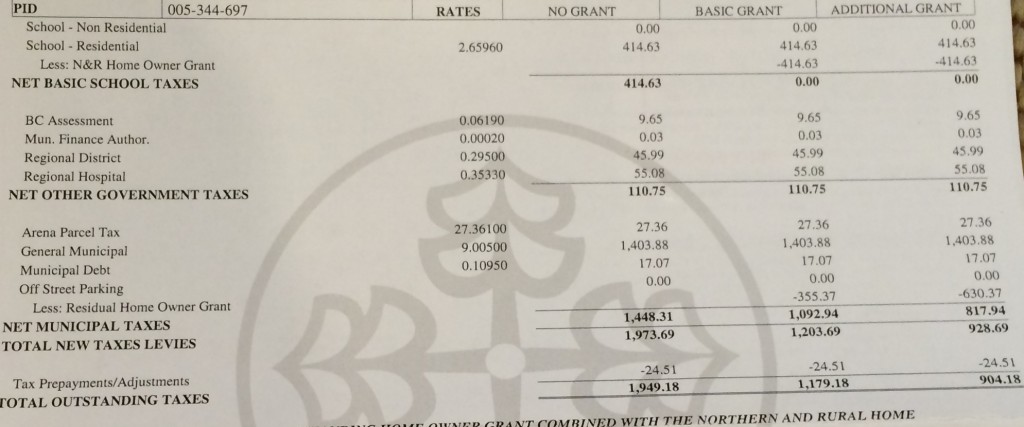

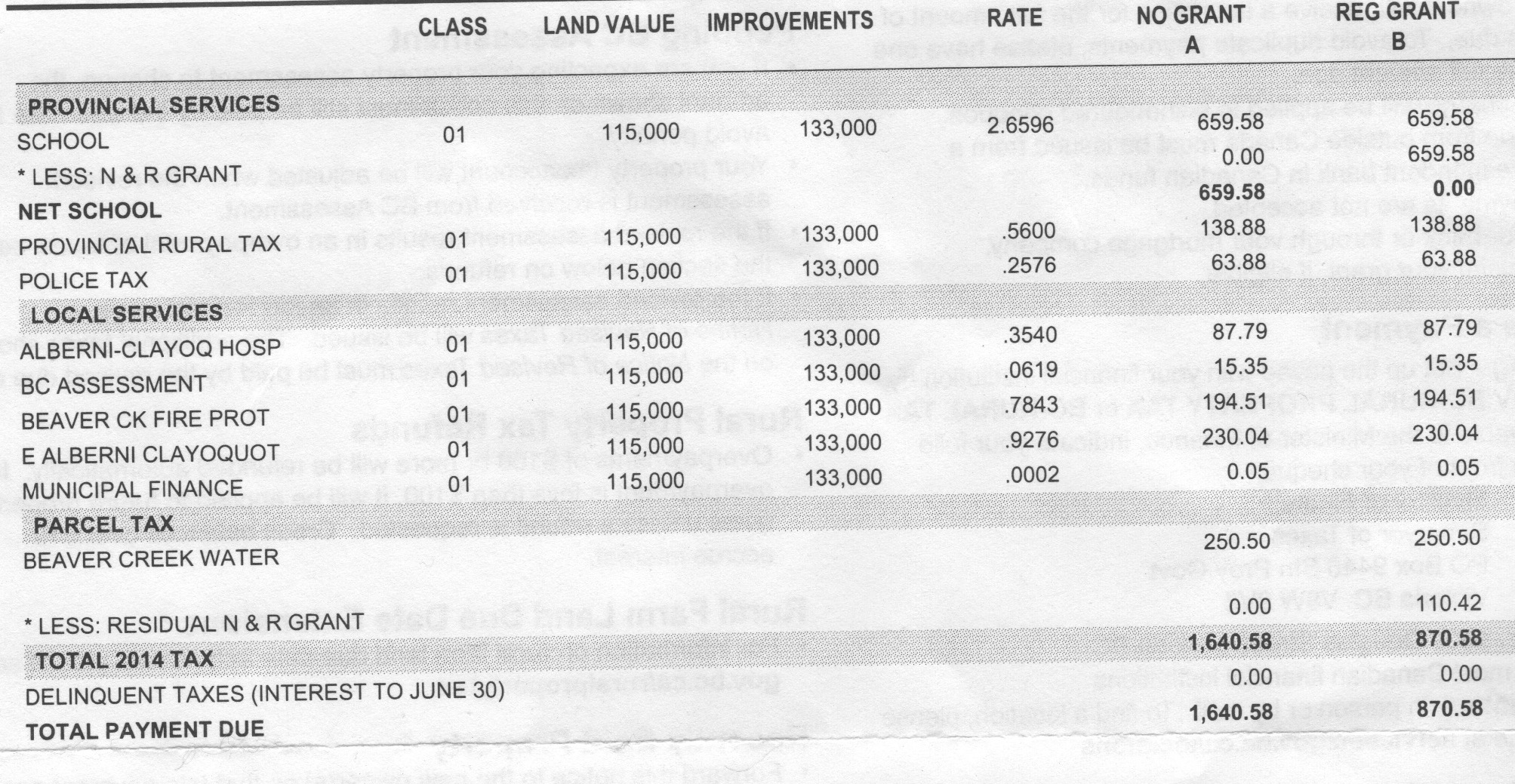

Here is my tax form for 2014 (I couldn’t find last years :)).  You can see the School, BC Assessment, Municipal Finance, and Regional Hospital rates.  These are all common whether you are in Port Alberni, Beaver Creek, Cherry Creek, etc.  By the way, my assessed value was $155,900 for this tax assessment.

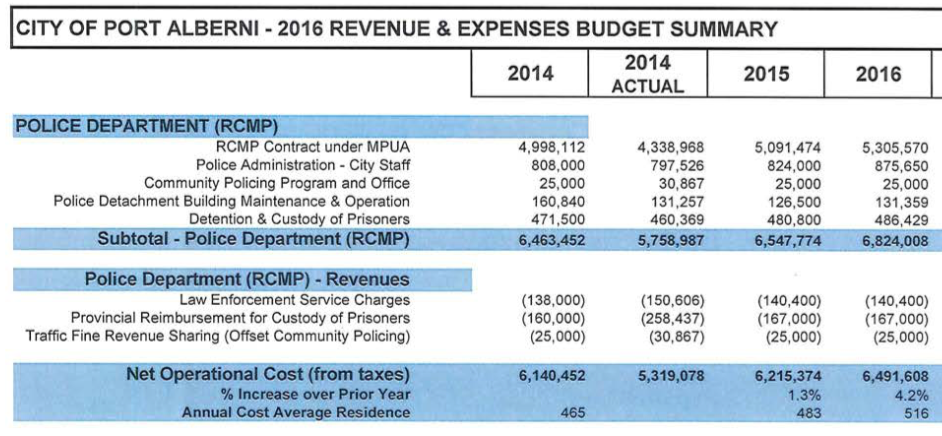

Here is a Beaver Creek property tax notice also from 2014 for a total assessed value of $248,200.

There are a few differences in Beaver Creek. First, there is a very small provincial “rural” tax rate (0.5600) that goes to the province for things like road work outside city limits.  There is also a small “Police Tax”…more on that in a second.  There is also a charge for the volunteer fire department and for the ACRD administration and a final one for water (which Beaver Creek buys in bulk from the City).  City residents have a similar, though smaller, ACRD charge on top of the “General Municipal” rate paid (9.00500) for all other services in the City and servicing the wider community.

By the way, the “Arena Parcel Tax” you see on my bill is common to all areas that originally agreed to pay for the new Multiplex.  It is not on the Beaver Creek bill possibly because that resident chose to pay the full amount at the time the Multiplex was built rather than have it added on to their tax bill until the Multiplex was paid off.  It does not go toward operation of the arena.

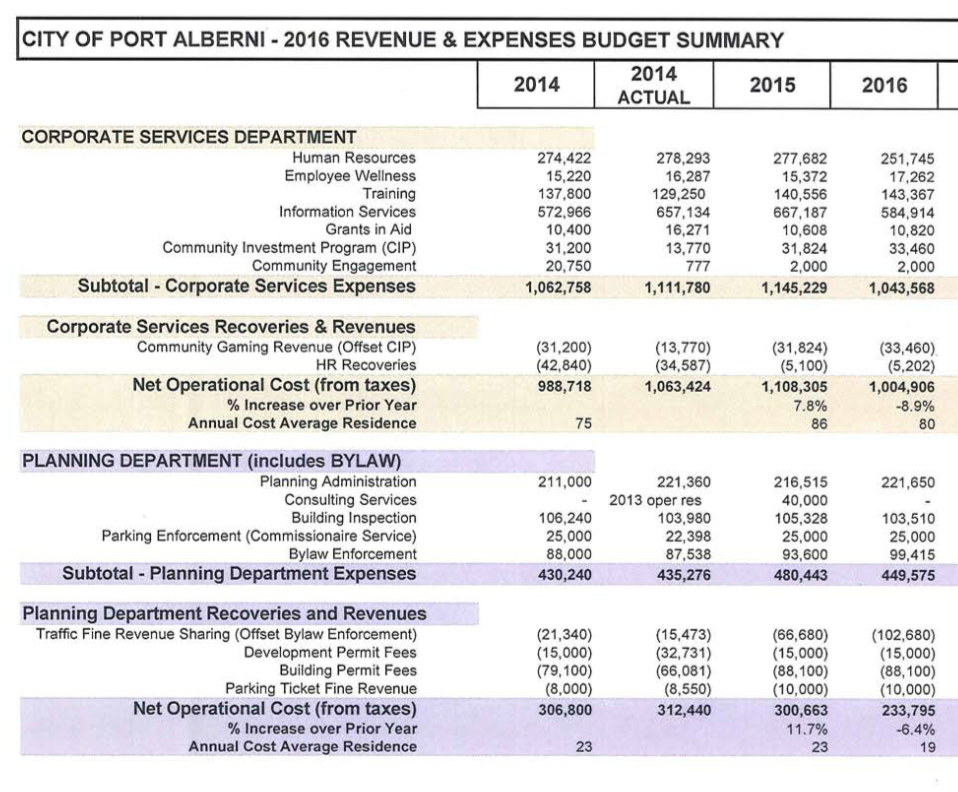

Let’s start with RCMP (image is from the Draft Financial plan in the January 11, 2016 agenda):

RCMP is the most expense budget in the City, about $500 on the average City tax bill, even though it serves the whole Valley plus Bamfield. Beaver Creek residents pay a separate rate on their bill for police of $63 for the services of the RCMP. This is despite the fact that there are a few City employees that do the needed administrative work for the detachment in addition to the vast majority of the expense which is of course the RCMP officers themselves.

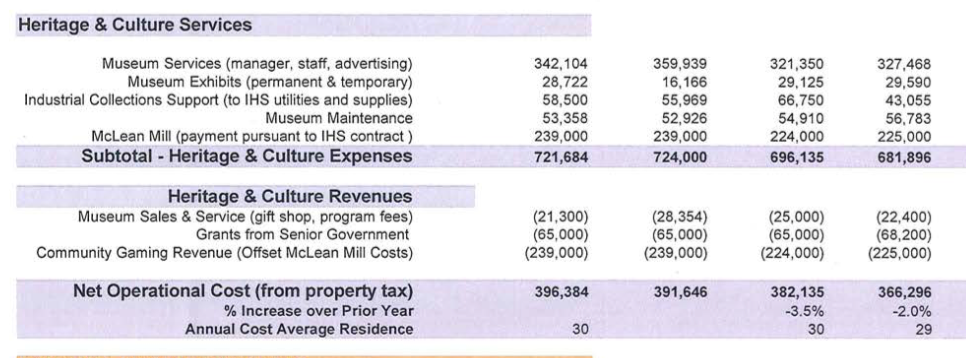

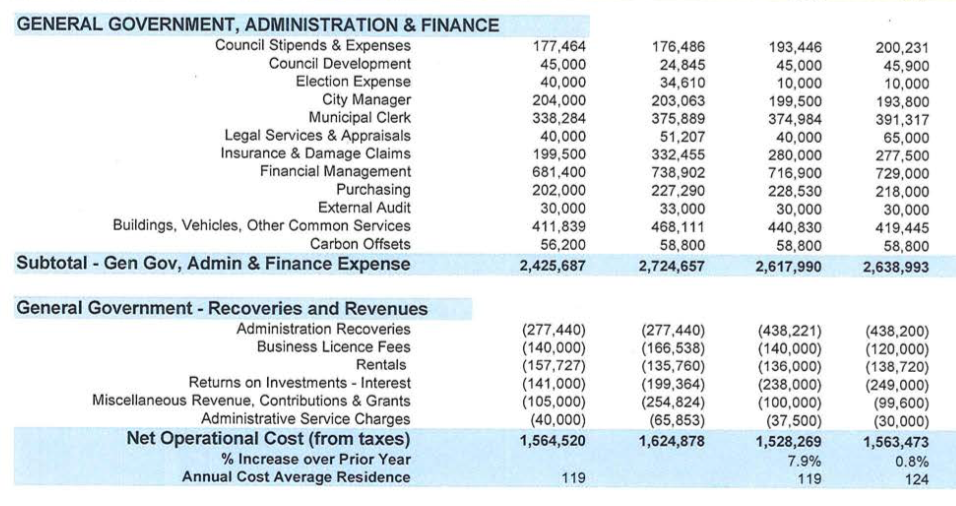

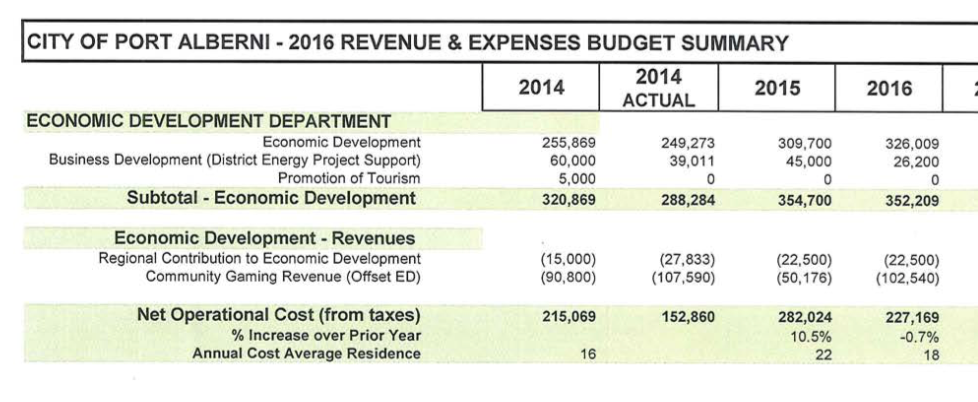

The RCMP cost is nearly twice as much  as the cost of all of the Administrative departments, with all their employees and managers and equipment of the City (Governance/Finance, Planning, EcDev, and Corporate Services) combined which only total around $3.5 Million or about $290 per average City tax bill for 5 divisions including the Heritage services.

It’s worth noting that every single one of those departments in administration in the City are absolutely necessary in order to service the businesses, not-for-profits, organizations and service centres that all folks with “Port Alberni” on their home address probably use. All of gone through multiple rounds of downsizing and most continue to shrink as the City tries to cut costs.

Of those, only the Museum and Heritage services department could be considered a “luxury” compared to the administration necessities, however there is something to be said about preserving the arts, culture and history of the Alberni Valley which the Museum does so well and which the McLean Mill celebrates. Â I am sure there would be readers who would say Heritage and Culture are necessities just as much as finance and bylaws.

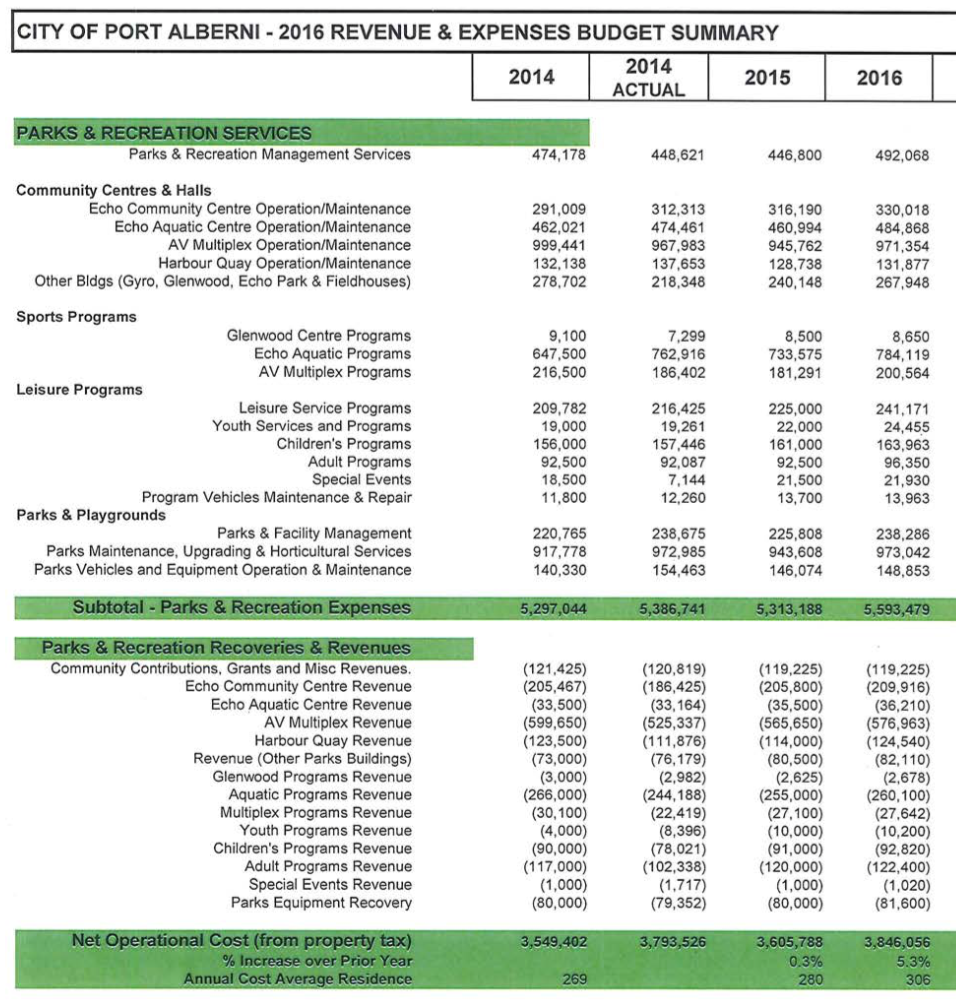

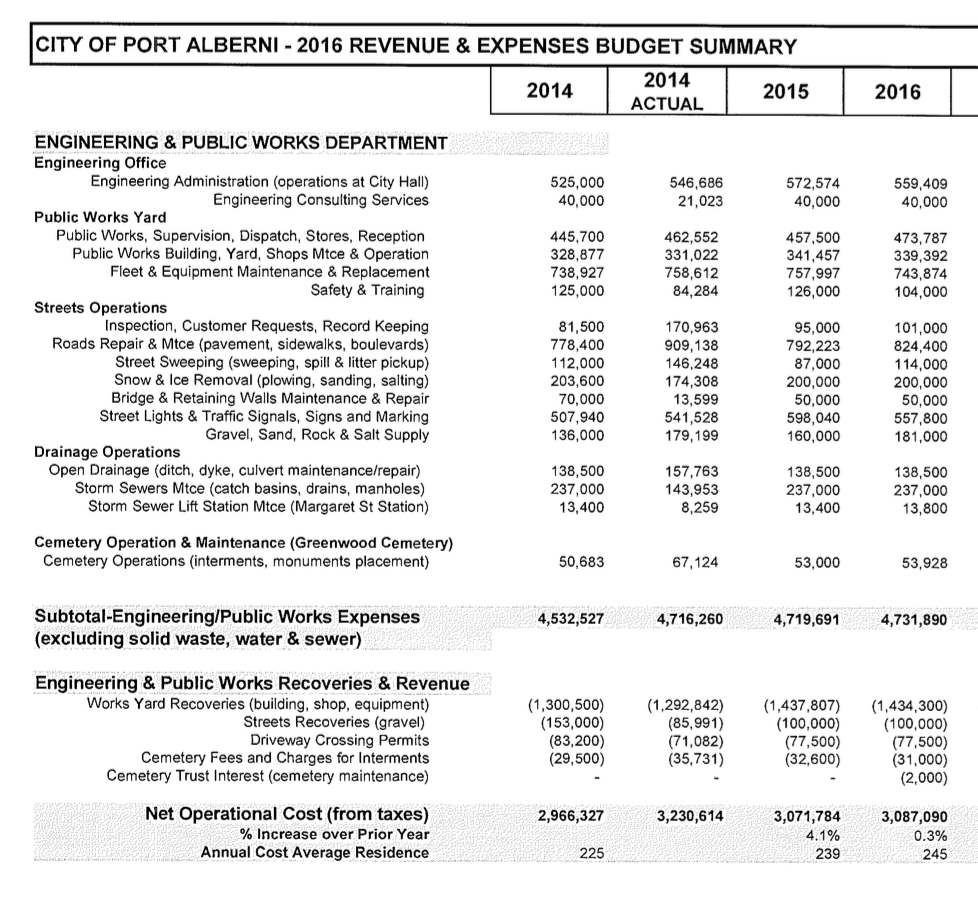

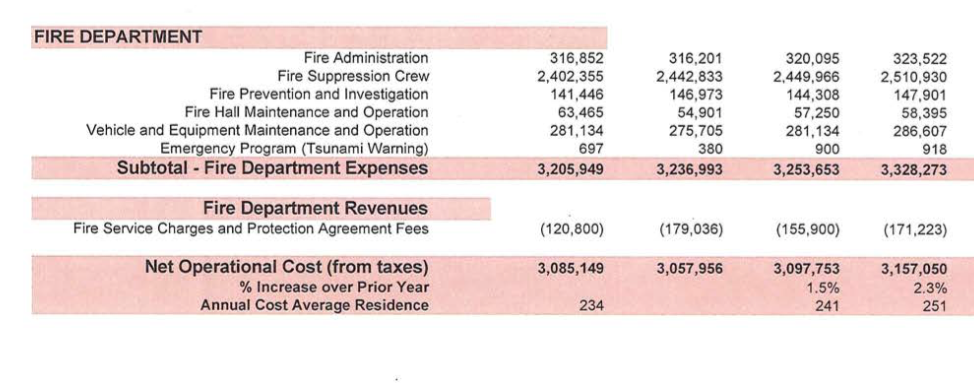

You’ll also notice that in the ‘2016’ column at the bottom of each section under “% Increase over Prior Year” most have gone down, many significantly, while RCMP budgets continue to rise largely out of the control of the City and Provincial grants to the RCMP budget lines decline.

The next most expensive department in the City Department is Parks and Rec ($3.6 Million) which includes all the buildings like the Multiplex, the Pool, Echo Community Centre and the other major city buildings as well as the actual parks, fields and other amenities.  Beaver Creek residents pay no taxes towards these facilities.

All of these require upkeep and operating costs. User fees only cover a very small portion of the costs, even when you include fees from people who live outside the City and use those facilities. All the city parks and upkeep and Harbour Quay and all people in them are included here too.

The next most expensive department is really a tie, between the Port Alberni Fire Department and City Engineering and Public Works. Â Both are in the $3 Million range so I’ll include them both here:

PAFD  is of course a paid rather than volunteer department, though again Beaver Creek does benefit from them as PAFD and BCFD and Sproat Lake FD all have an automatic aid agreement so they attend each others major fires automatically which benefits the region because PAFD can often get there very quickly and it benefits PAFD because it boosts the number of people at a fire so there is more rotation if a fire is really bad.  It is interesting that Beaver Creek residents still pay roughly half ($122 on my assessed value)  the cost City residents pay for fire service even though BCFD is volunteer and PAFD is fully paid.  The PAFD is also in charge of medical first responder from Cathedral Grove to Sutton Pass.  You’ll see only modest increases in the PAFD budget mainly due to contractual wage increases and equipment maintenance.

As far as Engineering, Roads and City Works all roads in City Limits except Johnston/RiverRd/Highway 4 are taken care of and paid for by City taxpayers. Paving, upkeep, sidewalks, cleaning, signals, etc. Roads are horribly expensive. Repaving just one section of lower 3rd Avenue from Napier to Burde (375 metres) is budgeted at $250,000 which is around $20 for every City resident.  By contrast, the “rural provincial tax rate” levied by the provinces costs Beaver Creek residents only around $80 (again using my assessed value) to take care of all of the roads and other general engineering work needed in the rural areas.  That’d be only enough to do a few blocks of work a year in the City.

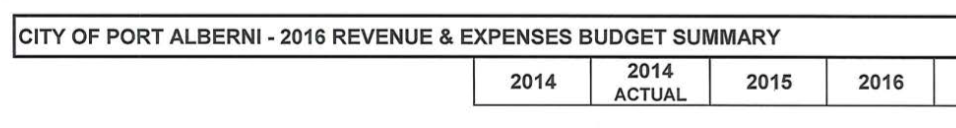

One Area that is often overlooked is the “External Services” which by its very name should indicate that these are areas that benefit more than only the City of Port Alberni.

The big expense here is Bus service.  Currently buses do not run outside City limits, so this is wholly paid for by the City with help from standard funding from the Province.  If Beaver Creek or Cherry Creek or other residents did want to have bus service they would need to advocate that their ACRD directors join with BC Transit and the City in funding the service.  In Nanaimo, for example, the BC Transit service is actually run through their Regional District so that it services Nanaimo, Parksville and smaller areas in between like Nanoose and Cedar.  However it does not service Coombs because that area did not agree to pay for the service.

The other big ticket on the external services is the Library Service.. but this is a cost that is the same whether you are in the City or Region. Â As of 2016, ACRD residents will see this as a separate tax rate on their bills split from the ACRD “E” (according to their area) line. Â This is a cost that is exclusive to the City even though obviously the Library is something that all citizens can and should access. Â The City pays for the Library through its association with the Vancouver Island Regional Library service so we can sometimes see costs rise when other communities build new libraries even when services here do not change.

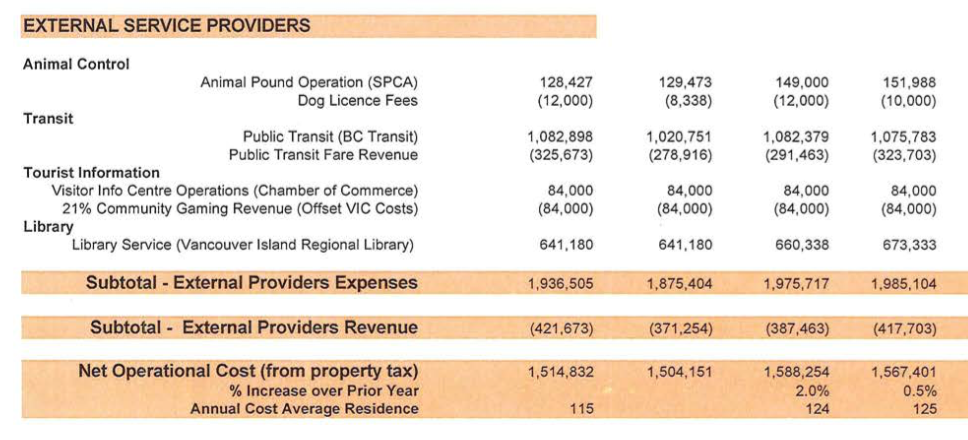

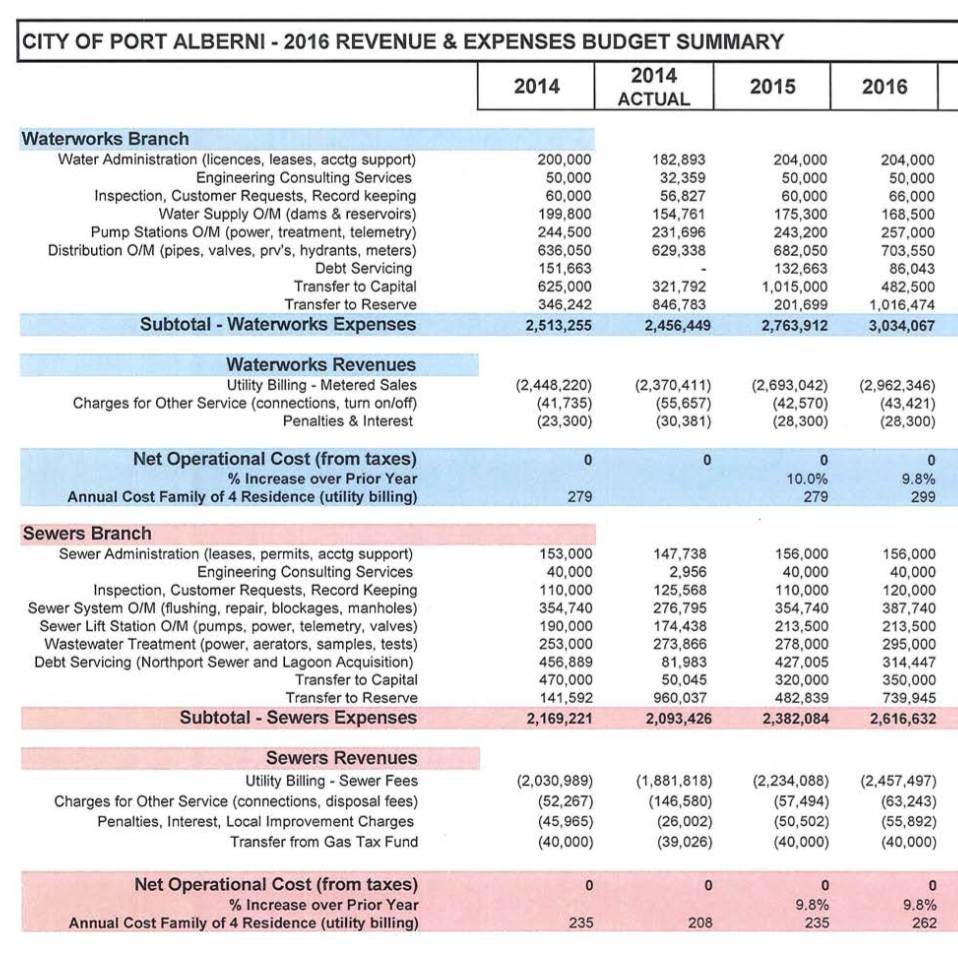

The last departments are Water, Sewer, and Garbage:

Water and Sewer are completely paid through user fees now so that is similar to Beaver Creek where you can pay for garbage pickup and you pay for water (which Beaver Creek now buys in bulk from the City) and your own septic services. That said, there are sometimes large projects that the city has to dip into its tax bank accounts in order to cover the cost of, say, a big road and sewer project or the new water treatment facility at China Creek that City taxpayers pay for that residents in outlying areas, even if they are paying for City water, are not paying for.

Long story short, there are a ton of things that Beaver Creek residents likely use or benefit from in the City of Port Alberni that they pay a fraction of the amount for in their taxes or fees, if they pay anything at all. So get your friend to buy you dinner. 😉

If the whole Valley was part of the City, tax rates would be much lower across the board because the average values of property would be higher and it would be spread out with more people, but the person in Beaver Creek would likely pay more tax than they do now, so good luck convincing them to join even if it is “fairer” for all especially for those on lowest incomes.

Hope that helps.

Chris

I don’t see a lot of silliness in the line items, though it doesn’t speak well that we have to spend so much on law enforcement. My eyes aren’t even glazed over. Thanks for doing this.

I think you should check your facts on library service Chris I think you will find that it is not exclusive to the city and that the Rural Areas pay the same mil rate as city residents much the same as the School or Hospital tax…..With none of those services within any rural area other than Bamfield

Thanks Tony, I haven’t seen anywhere that indicates rural resudents pay into the VIRL but if you know of any information please do pass it along and I can update the post. I am going from the Beaver Creek assessment as you can see and there is no line item for VIRL. That’s not say rural residents might not pay indirectly through the province but if they do it seems most likely at it is pennies on the dollar compared to municipal taxpayers.

thank you Chris I am not much on computers as to cut and paste etc. but if you go to the ACRD website and check the 2015-2019 Financial Plan Page 3 line 29 under expenditures Electoral Areas $424,607 dollars has been allocated…..I think you will find it is based on the same mil rate paid by a city resident. This will be the first year that our ACRD VIRL assessments will be pulled out and highlighted to the home owner even though as you can see we have been paying the same as the city for years

FYI. Beaver Creek and others also pay into the area parcel tax and annual parks and rec grant in aid.

Thanks Penny, I mentioned the Arena parcel tax up under Parks and Rec stuff. Do you know how much the grant in aid for parks and rec works out to as far as milrate for any of the districts? Is that info available anywhere?